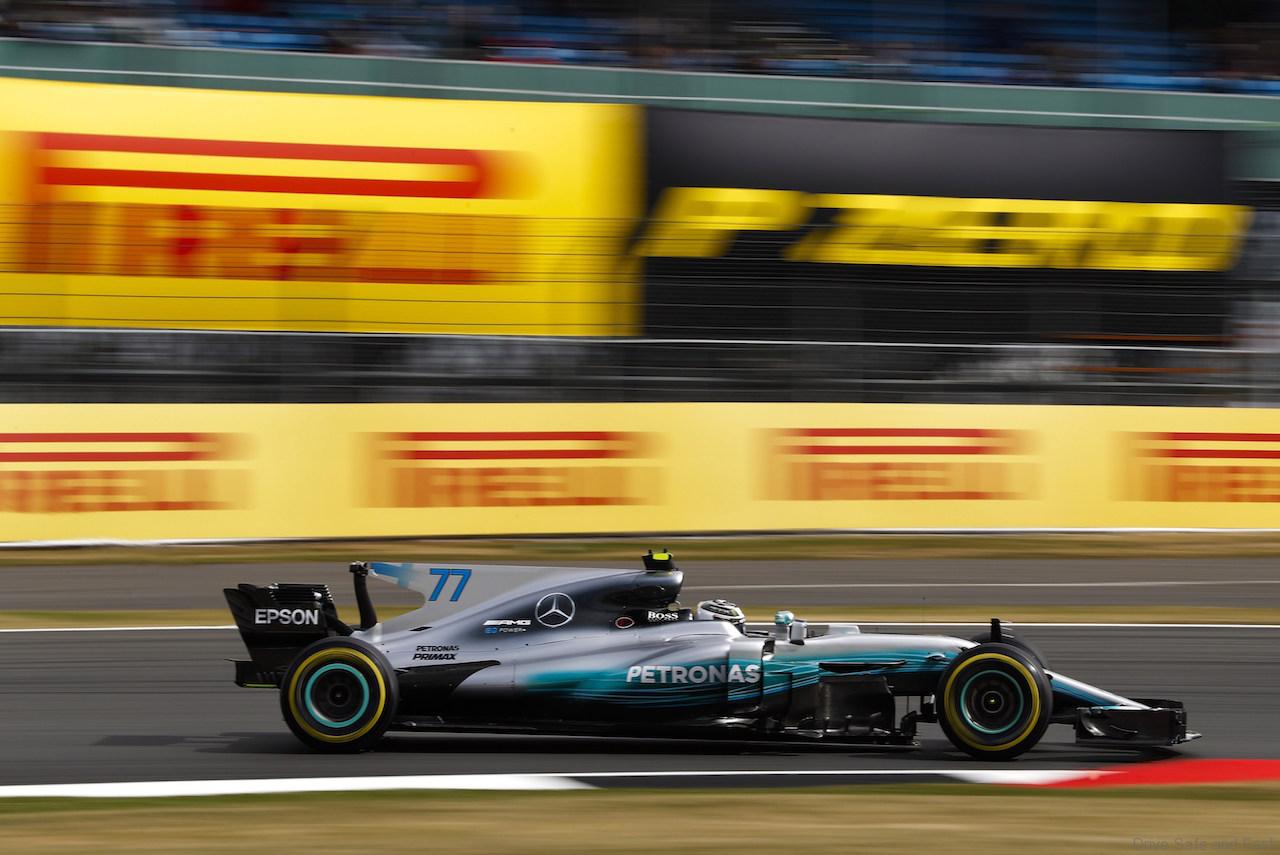

Marco Polo International Italy S.p.A. and Pirelli & C. S.p.A. have completed their global offering of Pirelli’s shares aimed at listing them on the Mercato Telematico Azionario.

Upon completion of the global offering, Pirelli said the capitalization of the firm, calculated on the base offer price, will be about $7.64 billion. Pirelli also will hold about 650 million shares, equal to 65 percent of the total share capital.

The firm said in a Oct. 3 news release that the global offering ended on Sept. 28 and received applications for an aggregate of about 824.3 million shares. About 400 million shares were allocated at about $7.64 per share. Of those shares, about 350 million were derived from those offered by the selling shareholder and about 50 million from the exercise of the over-allotment option granted by the selling shareholder in the context of the institutional offering.

The first day of trading on the Mercato Telematico Azionario was Oct. 4.

Within the institutional offering, Pirelli said applications were received for about 775.3 million shares from qualified investors in Italy and institutional investors abroad. Within the Italian public offering, applications were received for about 48.9 million shares from retail investors.

Pirelli said the aggregate demand of 824.3 million shares has been equal to about 2.35 times the maximum amount of the global offering.

The move is the latest in China National Chemical Corp.’s restructuring of Pirelli in light of its 2015 acquisition. The firm utilized Marco Polo International as an investment vehicle designed to facilitate the acquisition. The company holds a 65 percent stake in Marco Polo with Cam Finanziaria S.p.A. holding 22.4 percent and Long Term Investment at 12.6 percent, according to Pirelli.

ChemChina also combined Pirelli’s truck and farm tire assets with its own Aeolus subsidiary to form Prometeon Tyre Group S.r.l., which is estimated to have sales of about $3 billion.