Polestar takes a US$950 million loan from 12 international banks and has 3 years to pay them back.

Last month, in a pretty shocking announcement, Volvo Cars dropped its shares and financial support of Polestar – the electric performance brand that was co-founded with Geely. Geely became their direct majority shareholder. Now, the brand says that they’ve managed to secure US$1 billion in external funding and Volvo Cars will retain a 18% stake in the business.

The actual amount is US$950 million, but you can’t blame them for rounding up to the nearest billion. The money comes in the form of a three year loan facility from 12 major international banks. These include BNP Paribas, Natixis, Standard Chartered, BBVA, HSBC, and SPDB. This money will be used to cover Polestar’s next stage of developments and covers a majority of its financing requirements.

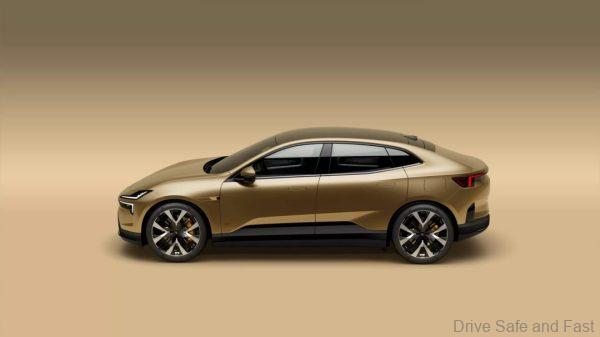

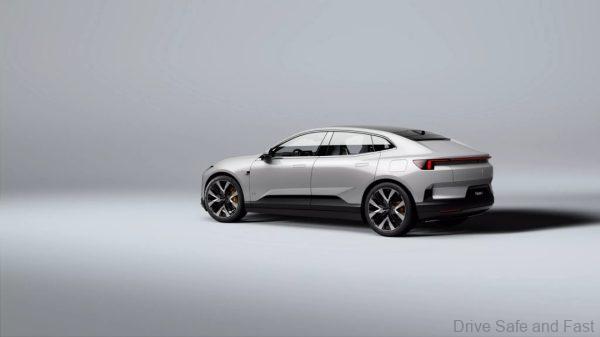

Besides the news about the loan, there are other things to note about the brand’s future. The company has already cut 10% of its workforce in the last 9 months. They anticipate another 15% of the company will be made redundant in the next 9 months. The company has production going in China and production will soon start in the USA as well. High-margin products are coming soon.

Thomas Ingenlath, Polestar CEO, says: “Securing funding from a syndicate of global banks reflects our partners’ support for Polestar’s growth course. Together with Geely’s full financial support and access to innovative technology and engineering expertise, we have reinforced our path towards cash flow break-even targeted in 2025.”

Daniel Li, Geely Holding Group CEO and Polestar Board Member, says: “As a strategic partner and direct shareholder in Polestar, Geely will continue to provide full operational and financial support to the iconic performance car brand going forward. We will retain our shares in Polestar and intend to participate in future financing activities when required. Polestar will have full access to technologies and engineering expertise from Geely Holding to realise its global growth targets.”