This iconic turbocharger manufacturer is going out of business.

Garrett Motion, a New York-listed auto parts manufacturer based in Switzerland, has just filed for a prepackaged Chapter 11 bankruptcy that would include a USD2.1 billion sale to KPS Capital Partners.

Garrett said it was seeking court’s approval for a USD250 million financing facility to bolster its cash position as it aims to continue operating its business during the reorganization process.

So, who is Garret and why is this news important to petrol-heads? The first turbocharged passenger cars were the Chevrolet Corvair Monza and the Oldsmobile Jetfire in 1962 and 1963. In the 1960s turbochargers were used in race-cars and sports cars, gaining an association with racing culture and auto-enthusiasts. By 1977, Volvo, Saab, Peugeot, Renault and even Mercedes were using garret turbochargers.

By 1978 there were already eight turbocharged car models worldwide on sale and seven used Garrett turbochargers.

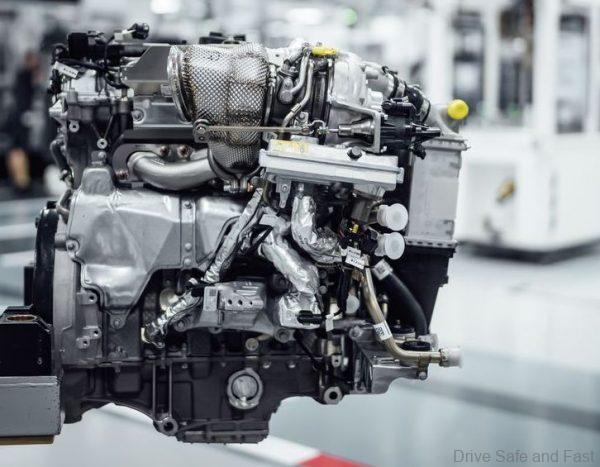

The latest Garret customer is Mercedes-AMG. Garrett’s breakthrough technology includes not only a turbocharger achieving speeds of up to 170,000 rpm as published by Mercedes-AMG, but also pushes the industrial limits for high-speed electric motors which must operate perfectly in extreme temperatures and conditions between the two wheels of a traditional turbo setup. Garrett has also developed the power electronics hardware and control software that support the electric motor.

While Garrett’s first E-Turbo application will emerge in Mercedes-AMG premium, high-performance vehicles, Garrett has 10 active global programs in varying vehicle segments capable of electrical regeneration to create energy supporting hybrid vehicle operation. Garrett’s E-Turbo program adds to its existing electrification portfolio which includes its TwoStage Electric Compressor for hydrogen fuel cell vehicles which went into production in 2016.

Garrett’s E-Turbo technology is just one example of how Garrett is well positioned to support future electric powertrains including hybrids as well as any other applications requiring a new approach to problem solving the most pressing needs of the industry.

“Although the fundamentals of our business are strong… the financial strains of the heavy debt load and liabilities we inherited in the spinoff from Honeywell – all exacerbated by COVID-19 – have created a significant long-term burden on our business,” CEO Olivier Rabiller says.

When the two companies separated in 2018, Garrett agreed to reimburse Honeywell for certain payouts to victims of asbestos exposure stemming from Honeywell’s Bendix division, but the company sued last year for a court order seeking to unwind the reimbursement deal.

In December last year (2019) Garrett Motion filed a lawsuit in the Supreme Court of the State of New York against Honeywell following “unsuccessful efforts to reach a negotiated solution with Honeywell’s executive team to avoid litigation.”

“The lawsuit arises from Honeywell’s unilateral imposition of an unusual 30-year Indemnification Agreement on Garrett immediately prior to the spinoff of Garrett in October 2018,” according to a press release. “This agreement, which was not negotiated at arm’s-length, requires Garrett to compensate Honeywell for payments relating to asbestos exposure arising from Honeywell’s legacy Bendix automotive brake business, including payments relating to punitive damages and defense costs.”