According to the China Passenger Car Association (CPCA), new car sales in China for the first two months in 2020 plummeted 80% which is the biggest plunge on record as COVID-19 worries reduced car showroom traffic to its lowest ever.

On average, car sales fell to 7,100 units a day during the month compared with 45,000 units per day in February 2019 which is largest automotive sales decline in two decades.

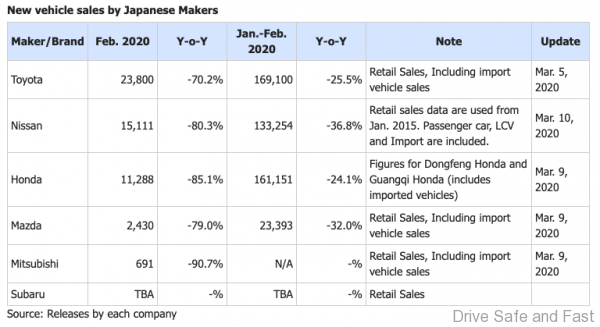

Toyota was the first major global automaker to report its February sales in China, said it sold 23,800 Toyota and premium Lexus cars last month, down by 70 percent from a year earlier.

This slowdown in car sales will take a toll on the earnings of most of the global car brands that have put most of their hope on China these past few years. Companies like General Motors (GM), Ford and Volkswagen among others. German auto giants BMW and Mercedes-Benz both are expecting to take a big sales hit in coming months.

GM which is the 2nd biggest foreign car manufacturer in China is saying that the situation will get better in the second quarter but their optimism seems unfounded.

COVID-19 has also forced many car manufacturers in Europe and Asia into a production slowdown as their car parts are coming from factories in China who have been forced to shut down and also movement of parts out of China have been stopped.

The Chinese government is trying to keep this multi-billion-dollar industry moving with stimulus packages and still there is little reaction from the population who have been quarantined and businesses who are facing forced closure in coming months due to a drop in sales.

In the southern city of Foshan the local government this month started providing rebates of as much as 3,000 yuan (USD430) to new car buyers. The Guangzhou’s municipal government is providing a generous 10,000 yuan (USD1.400) to buyers of new-energy vehicle (EV and Hybrid cars) while a development zone in the city of Xiangtan, in the Hunan province, has started offering a 3,000 yuan (USD430) cash rebate to those purchasing locally made Geely vehicles.

This is a shock to the Chinese automotive industry which has only seen growth in modern times, which is the past 30 years. Sales data from 1990 shows a relentless annual sales increases, in many years by the double digits. In 2012, China became the worlds largest auto market, overtaking the United States. In 2017, new-vehicle sales reached 28.9 million units. By comparison, in the US, new vehicle sales dropped to 17.2 million units, from the record of 17.6 million in 2016.

Meanwhile, Tesla Motors surprised every other car manufacturer in China for the month of February with a 33 percent market share of the Electric Vehicle segment. According to the China Passenger Car Association, Tesla delivered 3,958 cars in China in February which is 400 more electric cars than during the previous month.

The China Passenger Car Association also reported that Tesla sales was a healthy 30% of all new-energy vehicles sold in the month of February.