Hong Leong Bank Berhad has just scored big with this new credit/loan facility of up to RM5 million for each motorcycle and scooter dealer who is a member of the Malaysia Motorcycle & Scooter Dealers Association (MMSDA). Why? Well, think about it. Every single motorcycle and scooter dealer is already a millionaire and most of them have enough spare cash to even fund their own scooter/kapchai finance program with their customers. Yes, they are able to provide loans to customers with high interest rates and most buyers never run away for obvious reasons.

These motorcycle and scooter dealers also have a huge financial portfolio that can readily be managed by Hong Leong Bank Berhad. We are talking about housing loans, car loans, credit cards, short term loans, education and assurance, retirement plans and company payroll. This is the bigger picture that the other banks have not noticed, so Hong Leong shareholders will be happy to see their management team doing an excellent job in attraction a huge new credit worthy customer base.

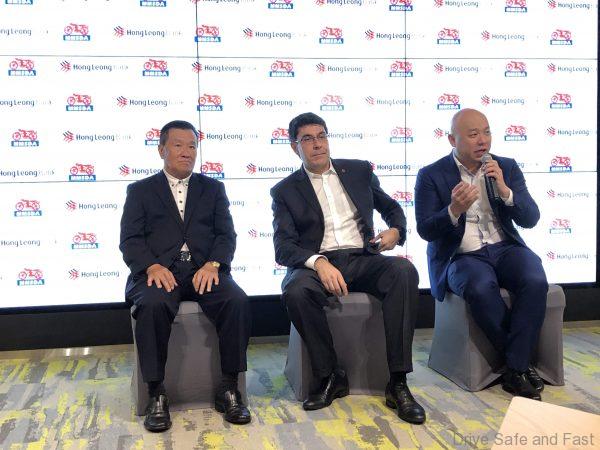

The MOU was signed earlier this week and it inked a partnership to provide a comprehensive suite of banking solutions to bolster the motorcycle and scooter industry and overall SME growth in the country.

From the partnership, MMSDA, as well as, 16 State Associations under MMSDA and over 6,000 of their members stand to benefit from the holistic financial products and solutions specifically designed to meet their business and individual banking requirements.

This includes a tailor-made financial programme, Motorcycle Dealers Programme (MDP) offering clean working capital financing with a limit up to RM5 million and eligibility for Auto Loan Packages, Cash Management, Payments and Merchants Services, Foreign Exchange Service and Digital Business Solutions.

According to Domenic Fuda, Group Managing Director and Chief Executive Officer of HLB, “The reality is while 98.5% of business establishments in Malaysia are SMEs, they cut across all sizes and sectors. At HLB, we believe financial products and services must be built around the needs of specific customer segments. We simply cannot provide a one-size fits all solution to SMEs as they operate in different industries and market segments and serve their customers differently and face different challenges and needs for business growth.”

“MDP which provides financing of up to RM5 million on a clean basis underwritten by the Bank is a testament to our commitment in delivering products and services that are tailored specifically to the needs of the motorcycle and scooter dealers. The portfolio has experienced three-fold growth in the past 18 months, thanks to our engagement with MMSDA and its’ members, and us listening to their needs, and delivering financial solutions that meet their requirements for business growth.

We hope with the Bank’s dynamic products and services, more dealers and retailers will be able to enjoy benefits that such financial solutions deliver,” added Fuda.

Rapid expansion of e-commerce, ride-hailing and delivery services have and will continue to increase the demand for motorcycles as primary vehicles for private and commercial mobility. According to the Malaysian Association of Motorcycles Manufacturers market dynamics have largely been positive since 2016 and the motorcycle and scooter industry is expected to witness continuous growth over the next 5 years with a projected 25% increase over the period.

“Working capital is always a concern for the SME and as a Bank with strong entrepreneurial roots, we understand the need for supportive financial arrangements to support entrepreneurs’ in their quest of business growth opportunities. Together with our existing flagship SME banking products including SMElite, digital banking solutions as well as Priority Banking, merchant facilities and payment products, we strive to provide the ultimate banking experience and other support with an aim to be the preferred banker of choice for Malaysian SMEs. Today’s partnership with MMSDA will be one of the many strategic partnerships that we will embark on,” said Terrence Teoh, Head of HLB SME Banking.

Teoh also shared that HLB was named Best SME Bank in Malaysia for 2019 by The Asian Banker, and that the Bank takes pride in having a strong pulse on the ground and having insights on what SMEs require to grow their business.

President of MMSDA, Mr. Wee Hong noted, “On behalf of the association, I am very excited to work with HLB who has identified our challenges and tailored their SME Banking services to the specific needs of the motorcycle and scooter industry. As automation and digitisation are rapidly changing the business landscape, this special partnership will empower dealers and retailers to further develop their business and remain competitive in the industry.”

The partnership covers the following benefits to the various stakeholders:

For MMSDA and the 16 Associations under MMSDA:

Current and Saving Accounts (CASA) & Fixed Deposits

For SME – Motorcycle and Scooter Dealers and Retailers:

SME Loans (MDP, SMElite, Business Auto Loan)

Cash Management

Payments and Merchants Services

Business and Key Man Insurance

Digital Business Solutions via HL ConnectFirst Lite:

· Biztory, an e-accounting and e-invoicing software solution,

· Kakitangan, an e-human resource and e-payroll platform,

· SimpleTax, an online Sales and Services Tax and Income Tax advisory tool

WeChat Official Account

Foreign Exchange

Personal Financial Needs for Members:

Personal Property Loan/Financing

Current and Saving Accounts (CASA)

Fixed Deposits

Credit Card

Forex

For more information, please visit: www.hlb.com.my/sme