Is Gentari up for sale, and is it so that it can grow or so that it can stop bleeding Petronas?

Malaysian state energy giant Petronas is reportedly considering the sale of a minority stake in its renewable energy subsidiary Gentari Sdn Bhd, signaling a potential major shift in the company’s green energy strategy. The move could value the stake between US$300 million to US$500 million, according to sources familiar with the matter. This report was first leaked by Bloomberg and reported by The Edge.

Expansion Or A Move To Stop The Bleed?

Established in 2022, Gentari represents Petronas’s ambitious push into the renewable energy sector. The company has positioned itself as a comprehensive green energy solutions provider, focusing on three key areas:

- Renewable energy development

- Hydrogen production and distribution

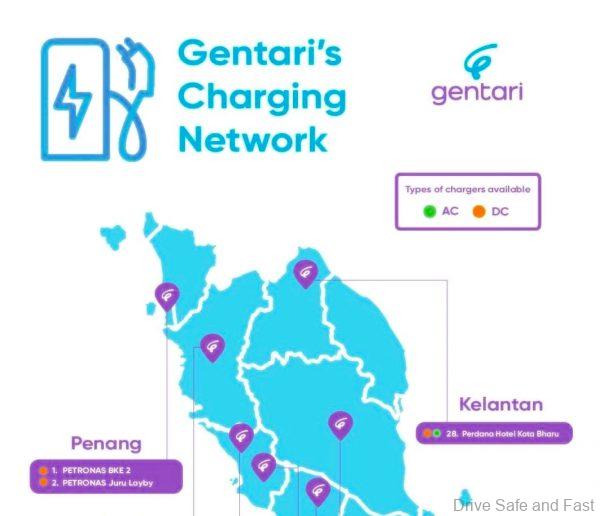

- Green mobility solutions

The potential stake sale is said to be aimed at accelerating Gentari’s business expansion, however, it’s also clear that Gentari is surviving on Petronas’ dime. That being said the company has already demonstrated significant progress in its renewable energy portfolio. As of early 2024, Gentari has achieved a cumulative capacity of 3.6 GW, with 2.4 GW already installed and operational.

However, it’s also obvious that this independent company isn’t profitable and Petronas may be losing their patience. In an interview with The Edge in May 2023, Gentari was asked if they had a timeline to be profitable and this was their answer:

“There is very strong backing from Petronas for us to execute our projects but we are an independent company and we will also pursue funding from outside to accelerate our growth. It could be external investors, project-level investment or debt financing. We cannot share that kind of target at this point in time. Currently, we are in the venture-building phase.”

Ambitious 2030 Targets

Gentari has set ambitious targets for 2030, including:

- Developing 30-40 GW of renewable energy capacity

- Establishing significant hydrogen production capabilities

- Expanding electric vehicle infrastructure and adoption

Investment Interest

The stake sale has reportedly attracted attention from various potential investors, including:

- Infrastructure investment funds

- Industry peers in the energy sector

Petronas has engaged financial advisers to explore the potential transaction, though discussions remain in preliminary stages. The exact size of the stake and final valuation are still under consideration.

Market Impact and Future Outlook

This potential move by Petronas reflects a growing trend among traditional oil and gas companies to accelerate their transition toward renewable energy through strategic partnerships and capital raising. The stake sale, if completed, could provide Gentari with additional resources and expertise to achieve its ambitious 2030 targets.

However, sources indicate that the transaction is not guaranteed, and Petronas may ultimately decide to retain full ownership of Gentari. The company’s careful consideration of this strategic move demonstrates the complex balance between maintaining control and securing growth capital in the rapidly evolving renewable energy sector.

This development comes at a time when global investment in renewable energy continues to surge, driven by:

- Increasing focus on sustainability

- Growing corporate commitments to clean energy

- Supportive government policies worldwide

As Malaysia’s largest energy company, Petronas’s strategic decisions regarding Gentari could have significant implications for the Southeast Asian renewable energy market and the region’s energy transition efforts.

Note: This article is based on information from sources familiar with the matter, as Petronas has not officially commented on these developments.