Volvo Cars will push off Polestar to Geely as EV sales plummet.

Volvo Cars will cease funding Polestar Automotive Holding, a separate luxury car brand in which it owns a substantial 48% stake. The responsibility for Polestar will now be transferred to Volvo’s major shareholder, China’s Geely Holding. This decision has sparked significant market reactions, with Volvo’s stock witnessing a remarkable surge of over 30% at market open.

Polestar, like several other emerging electric vehicle (EV) brands, has encountered obstacles in making headway, especially in the wake of a price war initiated by Tesla. The luxury car brand went public in June 2022 via a merger with a Special Purpose Acquisition Company (SPAC). In recent years, Polestar has expanded to markets like Singapore, where it been met with some success.

However, the company has fallen short of its already-reduced delivery targets for 2023. Last week, Polestar announced plans to cut approximately 15% of its workforce, reflecting the challenging market conditions.

Analysts have long criticized Volvo’s heavy involvement in Polestar, viewing it as a drain on the automaker’s resources. There were considerations of distributing Polestar shares among Volvo’s shareholders, potentially making Geely a significant direct owner in the brand.

Geely Holding expressed its support for Volvo’s decision, pledging full operational and financial backing for the independent exclusive brand, Polestar. Geely emphasized that this support would not necessitate a reduction in its shareholding in Volvo Cars.

Polestar aims to become cash flow break-even by 2025, despite the recent challenges. The company has outlined plans to reduce its reliance on external assistance, including additional loans from Volvo and Geely. However, questions arise about the viability of Polestar, leading some analysts to suggest that merging Polestar into Geely could be a more logical solution.

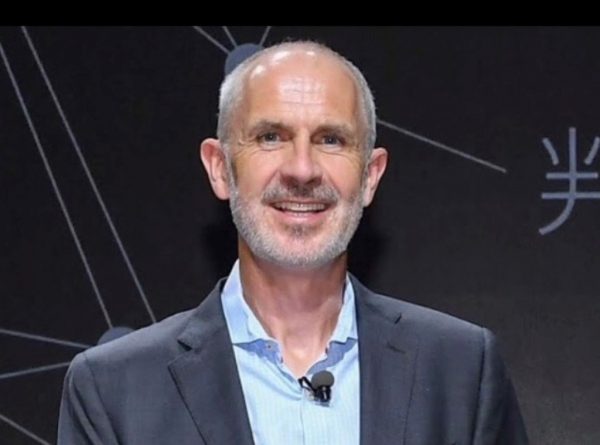

In the midst of these developments, Volvo Cars reported great 2023 numbers, surpassing expectations. Volvo’s BEV margin increased to 13% in the quarter, supporting CEO Jim Rowan’s confidence in the company’s ability to maintain rising margins, despite industry concerns about EV demand and lower-than-expected margins.