How many potential EV buyers in Malaysia are waiting for a road tax announcement?

Last week, PM Anwar Ibrahim tabled the 2024 Budget in parliament. It featured quite a bit of spending on infrastructure maintenance, which is to be commended. It also boldly announced the end of blanked diesel subsidies and the start of targeted diesel subsidies in phases. The adoption of Electric Vehicles was also touched upon. Unfortunately, there was one aspect that the Budget 2024 failed to address directly – the electric vehicle road tax situation.

To be fair, YB Anthony Loke’s Ministry of Transport did not set a hard deadline for this. He indicated that it might be possible to share a new formulation by the end of the year and there are still a couple of months left before that ‘soft’ deadline is reached.

That being said, we can’t help but wonder if the government realises how tough that makes things for potential EV owners in Malaysia. Yes, JPJ has already confirmed that the current road tax rate calculation for EVs will not be reinstituted when the road tax break expires at the end of 2025. That being said, it’s still a huge unanswered question for potential buyers and current owners as well.

Think about it, there is no accurate way to gauge what it’s going to cost to run an electric car in 2026, which is just over 2 years from now. Most people don’t sell their cars after 2 years and for now any electric vehicle owner must be prepared to swallow the 2-year depreciation should the new EV road tax formulation be higher than expected.

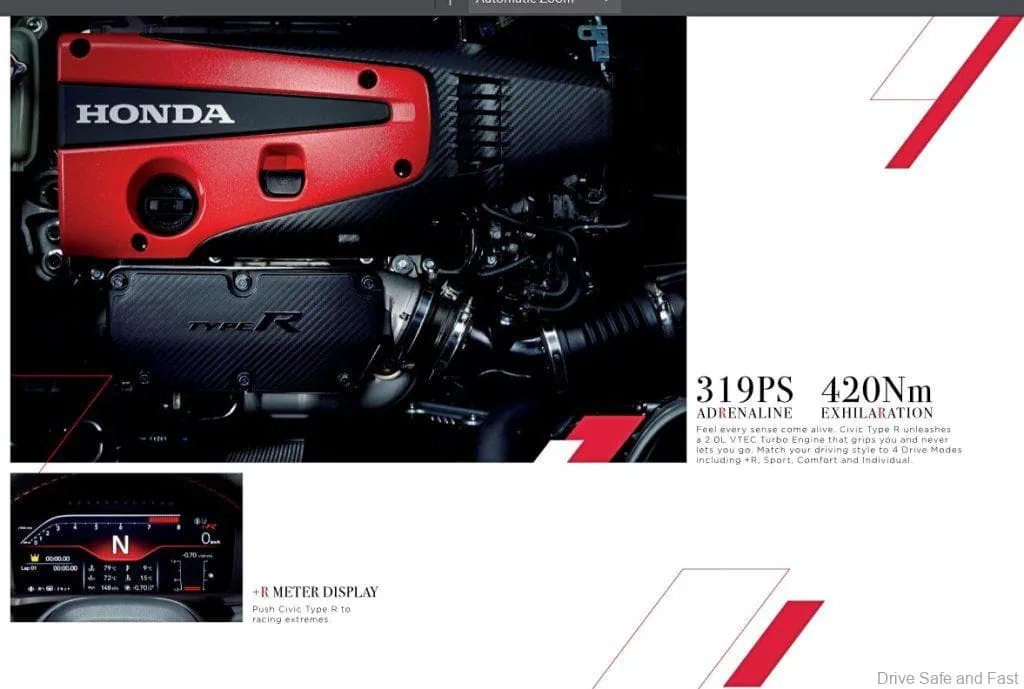

Some may be willing to take the risk and believe that the government will be proportionate in its road tax formulation, but there is no indication for what is being planned. Even with petrol and diesel cars, there’s only an antiquated logic to how it all works. A 2.0L 2023 Civic Type R owner pays the same road tax as a 2.0L 1994 Honda CR-V owner after all – and those two cars are nothing alike in value, motor output, fuel economy, emissions, etc. The road tax rate also increases almost exponentially with displacement past 2.0L.