Is the moratorium a scheme to help the rakyat, or to make money for the banks?

After the government announced harsher lockdown rules at the end of June 2021, they also announced another wave of mandated moratoriums. These are opt-in, but automated in approval for all unlike the previous ones. We go into detail, specifically with regards to hire purchase loans for cars to help you understand it.

Here’s a breakdown for those who prefer to read the explanation:

- We are not financial advisers. If you need immediate financial relief, take whichever deal makes sense to you.

- There are two broad categories of financial relief offered by all banks: TARGETTED ASSISTANCE and MORATORIUMS.

- TARGETTED ASSISTANCE

- This is up to the bank’s discretion. If your relationship with the bank is good, the bank may be open to renegotiate your loan terms

- This is NOT mandatory and NOT offered by all banks.

- As this is highly customised, we cannot reasonably cover this

- MORATORIUMS

- 6-Month Moratorium + 6-Month Term Extension

- The 6 month moratorium is mandated by the government. All banks must offer it to all customers who apply for it

- The 6 month moratorium comes with a 6 month extension

- Application for the moratorium needs to be done by YOU, but approval will be automatic

- There will be a charge imposed by the bank for this moratorium that you will have to settle at the end of your tenure

- The charge is entirely dependent on the bank, but it appears to be a flat fee, NOT compounding interest

- Alternative Options

- 50% payment for 6 months with no term extension

- Offered by Maybank, Public Bank, Hong Leong, RHB (for now)

- 3-Month Moratorium + 3-Month Term Extension

- Offered only by CIMB (for now)

- 50% payment for 6 months with no term extension

- 6-Month Moratorium + 6-Month Term Extension

Does it help the rakyat or make money for the banks?

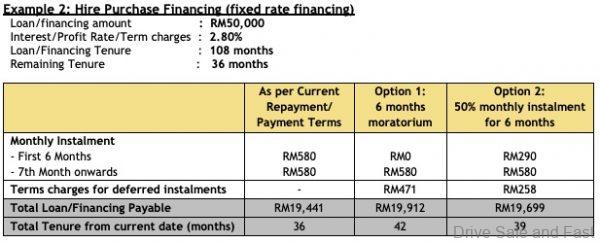

Well, any assistance at all will help, so broadly speaking, this moratorium is a good thing. But to help understand if the banks are benefitting from this, we have to look at it from the point of view of the banks. Here’s an example shared by Maybank:

In this example, a 9-year loan for RM50,000 with 2.8% interest is used. The loan only has 3 years of repayment outstanding.

What happens when the 6-month moratorium with 6-month term extension is taken?

- no monthly repayments of RM580 the next 6 months are required

- the loan term extended by another 6 months

- the RM3480 (RM580 X 6) that you’re not paying is NOT free money, the bank will be charging you interest

- on the last month of the loan, you’ll have to pay not only the remaining RM580, but an additional RM471 as interest for the RM3480 they ‘lent’ you for 6 months

What happens when the 50% payment for 6 months with no term extension is taken?

- month repayments drop to RM290 for the next 6 months

- the loan term is NOT extended

- the remaining RM1740 (RM290 X 6) months that you owe the bank is brought forward

- on the last month of the loan, you’ll have to pay not only RM290, but you have to pay RM1740 AND RM258, which the bank’s interest on the RM1740 they have ‘lent’ you for 6 months

As you can see, the 6-month moratorium with 6-month term extension is a lot less burdensome, especially in the final month of payment.

Using the Maybank example above, treat the RM3480 that you’re not paying for 6 months not as free money, but as a loan. Do this because you in fact will be paying interest of RM471 on it at the end of your loan tenure.

RM471 is 13.53% of RM3480, but to be fair, you have to calculate how many months you have left on your loan to see how this actually works in the banks’ favour.

If you have just 6 months left on your loan (last payment in December 2021), and you opt-in for the moratorium, your new last date will be June 2022. So between now and June 2022, you have 1 year. You’re effectively getting a ‘loan’ from the bank at 13.53% interest, close to Ah Long amounts.

However, if your last date of repayment is December 2022 and you opt in, then the story is different. Your new last date will be June 2023. In which case, you have 2 years. The interest rate is now effectively 6.7%, which is closer to typical personal loan interest.

Typically, banks want to earn more than 2% interest, otherwise, they’re not making money at all. So with this repayment scheme provided by Maybank, the longer you have left on your loan, the less the banks will be ‘profiting. It gets to a point around 4-5 years where the burden of the moratorium is shared with the banks.

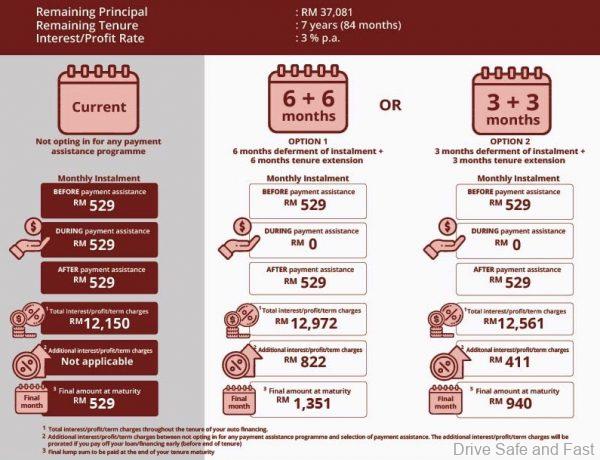

We have to note that not all banks are charging the same amount of interest. CIMB’s is particularly harsh:

The 6+6 months chart in the middle row is representing the 6-month moratorium with 6-month term extension.

For CIMB, the example used equates to a loan of RM3174 (RM529 X 6 months) with interest of RM822.

RM822 is 25.9% of RM3174! That’s a LOT LOT more than what Maybank and many other banks are doing.

Using the same example as we did with Maybank:

6 months left on loan before application: 25.9% interest per year

18 months left on loan before application: 12.95% interest per year

In fact, CIMB seems to be making some amount of profit on this moratorium regardless of how many months left you have on your car loan. Perhaps if you JUST took a 7-9 year car loan from CIMB this year, you can get away with lower interest on your moratorium, otherwise it doesn’t look like they’re sharing the burden.

Oh, and CIMB’s 3-month Moratorium with 3-month term extension is actually just as bad in terms of interest alone.