This is good news for middle class Malaysians looking for the best priced Electric Car.

Here is a picture of the Great Wall Motors Ora R1 compact electric car which made headlines in July 2020 when it was shown at the Auto Expo 2020 in India. Spotted on the move from Klang, straight off the cargo ship and on its way to the Haval headquarters in Glenmarie, we can only assume that its market launch is just around the corner.

Its factory selling price in China starts from RM70,000 before local taxes and delivery costs, this could be the start of the Malaysian electric vehicle (EV) movement in full gear for the average car buyer.

Yes, the take up interest in electric vehicle must start with a well priced EV below RM90,000 for lower and middle class Malaysians to be able to purchase and have it as a second vehicle in their home. With range issues and charging infrastructure still in its infancy, the first car in the garage will still need to be a petrol or diesel powered vehicle for the average Malaysian car buyer.

The Ora R1 was launched in China with a generous Chinese government subsidy at a low selling price of 59,800 RMB to 77,800 RMB (RM37,975 to RM49,406 before local taxes and delivery costs).

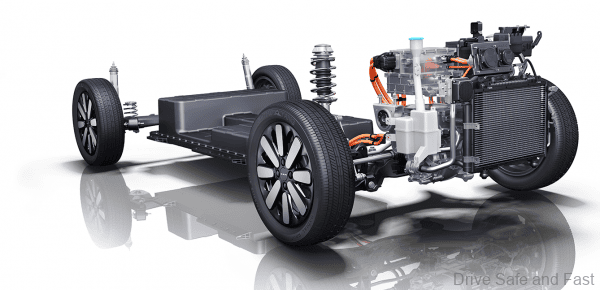

The Ora R1 comes from the factory in 3 power configurations which starts with a 28kWh Battery pack to a 37 kWh battery pack and a motor generating from 35kW to 45 kW (61.18 PS). The possible emission free driving range is from 301km to 405 km (NEDC test).

Ora R1 Safety Features:

- ABS with EBD

- Hill start assist

- Driver and C0-driver front Air-bags

- ISOFIX child seats

- Child door lock

Ora R1 Key Features:

- Voice Control-Hello Ora!

- Multi-function steering wheel

- Front and Rear Ventilated seats

- Front and Rear Armrest

- Sensor LCD Screen with Bluetooth

- USB for External audio interface

- Front and Rear Power Windows

- Rear Windshield defrost

PRESS RELEASE: Ning Shuyong, vice-president of the Baoding-based vehicle maker, said Great Wall had begun studying ways to build out its global distribution system for electric vehicles with the ultimate goal of selling to Europe, part of the company’s efforts to go global.

The group unveiled in September the first model by Ora, the iQ crossover. The company has since secured orders for more than 10,000 iQs, which have a range of 301-405 kilometres between charges, according Ning.

“We have the vision to become a market leader in the electric vehicles segment in China,” said Ning, who is also general manager of Ora. “Our cars are designed and built in compliance with international standards and we definitely set our sights on international markets including Europe.”

Ora will unveil its new model R1, a four-seat mini electric vehicle with a range of up to 405km in mid December.

The R1, which will have a sticker price of about 110,000 yuan (USD15,817 before government subsidies), takes on Chery Automobile Company’s Ant mini and JAC Motors’ iEV6 on the mainland. Central and local government subsidies are expected to offset the price to consumers by as much as 50,000 yuan.

Small electric vehicles make up the largest share of China’s new-energy vehicle market, with sales of 400,000 units a year.

Ning said a market leader in this segment would need to sell about 100,000 units a year. He would not disclose whether Great Wall would make its Ora vehicles as part of a joint venture with BMW.

In July, Great Wall agreed with BMW, to form a 50-50 venture, Spotlight Automotive, to produce electric vehicles with each party contributing half of the total 5.1 billion yuan investment.

Under the “Made in China 2025” industrial strategy, new-energy vehicles is one of the 10 key sectors that Beijing hopes domestic players can catch up with leading global brands and become self-sufficient.

The central government wants domestic carmakers to produce 3 million electric vehicles a year.