By now, you’ve probably heard from The Edge that the government lost out on some RM4,890,000,000 in excise duties from CKD vehicles between 2015 and 2017. This was taken from the Auditor-General’s Report 2018 Series 1.

The lost duties were from excise duty exemption was given to state assemblymen, members of Parliament, embassies, the government, the Returning Expert Programme, Malaysia My Second Home Programme via special approval from the Ministry of Finance as well as through the EEV incentive scheme.

If you want the full report and break down of those other stats, here’s an article that break down this information more clearly.

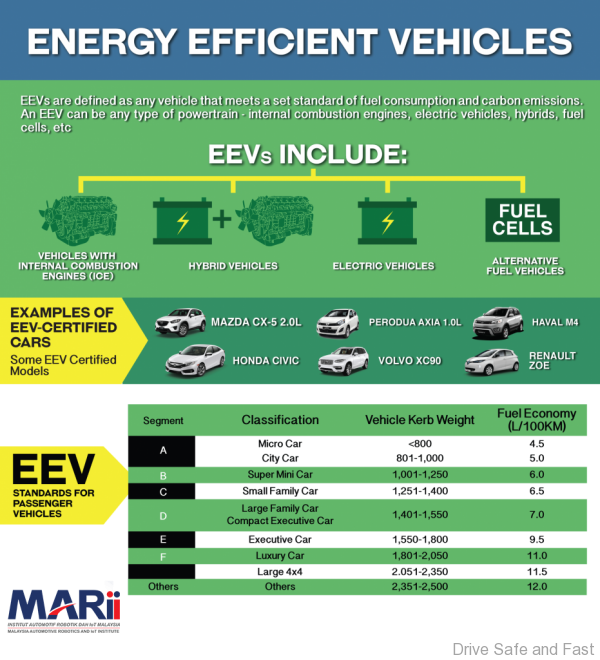

Our interest is solely on the EEV incentive scheme, which we’ve pointed out over and over again was unfair and benefitted only the richest Malaysians and premium carmakers.

In fact, when we look at the breakdown of how much excise duty was lost by brand, we can see that it really was the premium European brands that took the cake. Based on data from the Royal Malaysian Customs, cars sold by premium European brands made up RM3.421 billion or about 70% of the lost revenue.

Who Benefitted from This?

Without excise duties, obviously, the final price of each car comes down. But it also puts more control over pricing in the hands of the manufacturers, as they can decide to leverage lower prices by increasing equipment levels or increasing margins on hot selling items.

In a lot of ways, this made things more competitive in the premium segment and the Malaysian upper-middle class benefitted greatly from some of the best-priced flagship models we’ve ever seen.

We don’t blame most of the car companies and we don’t blame the buyers either. It’s the duty of these companies to make money for their shareholders and if you’ve got the money, by all means, spend it whichever way you want.

But here’s the real kicker. We know that some companies got incentives by bypassing the standard channels. We know this from a Press Release issued by the Ministry of Trade and Industry back in January which reads:

“In the previous Administration, some vehicle companies had obtained the incentives directly from MOF, bypassing ABDC [The committee set up to regulate incentives]. Many of the applications were approved without comprehensive evaluation in determining the return of investment to the Government.”

What we want going forward

OK. We can’t change what happened in the past. And as the same press release reads, the process is more transparent now:

“However, in line with the aspiration of the new Government, MOF and MITI collectively agreed that the decision-making process has to be transparent and fair and should be comprehensively deliberated by ABDC.”

That’s great. So while the NAP 2019 is being formulated, let’s suggests some questions that may help.

- Should an opaque ‘cost-benefit analysis’ be replaced with a transparent formula or equation that both product planners and the rakyat have access to?

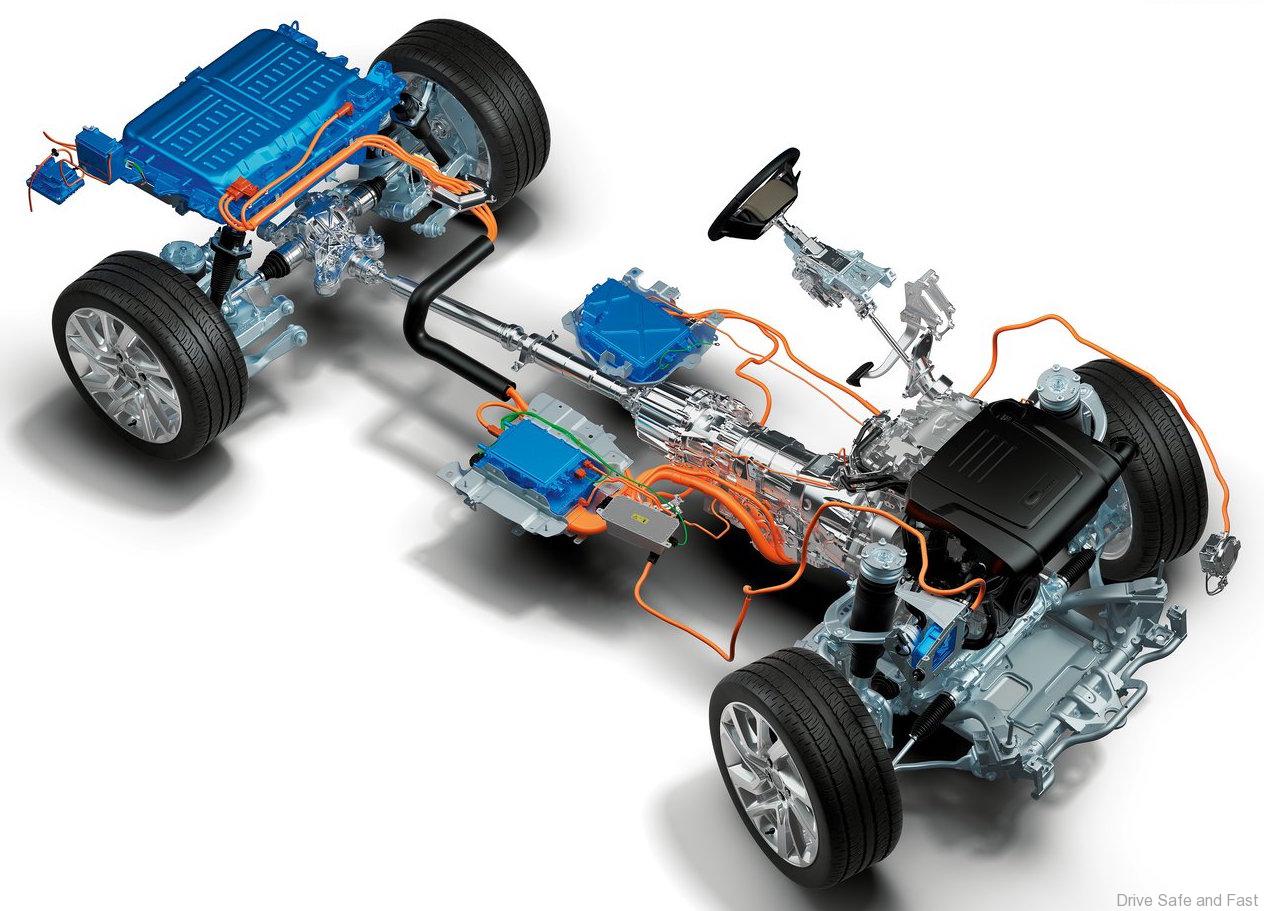

- Is there a realistic ‘transfer of technology’ if powertrains and chipsets are still brought in as completed units? If these are locally assembled, do Malaysian companies learn anything about the technology or are they just screwing things in and welding things on?

- Are there any parties in the ABDC who may have a vested interest in particular brands? Is there a risk that they may serve as ‘lobbyists’ in the interest of certain brands?

*all images used are for illustration purposes only